Abstract

Growing foreign direct investments (FDIs) have been observed in parallel to the development of tax avoidance by multinational enterprises; however, empirical evidence indicates the asymmetric effects of trade costs on a firm’s entry decision. To give a new rationale and insights into the impacts of transfer pricing and trade liberalization on a firm’s global activities, this study incorporates transfer pricing and investigates a foreign firm’s entry decision: exports, greenfield FDI (GFDI), or cross-border mergers and acquisitions (CM&As). We show that CM&A is the equilibrium entry mode when transfer pricing regulation is loose, whereas the choice between exports and GFDI depends on the fixed costs of GFDI. Moreover, trade liberalization increases the likelihood of CM&A but decreases that of exports because a reduction in trade costs enhances tax-avoidance efficiency due to more intrafirm trade, implying that tax avoidance in the form of CM&A becomes crucial as globalization progresses. Our welfare analysis shows that regulating CM&A based on consumers’ benefits may result in welfare reduction because profit shifting is most effective under CM&A and a host country’s tax revenue from the foreign firm increases. The results imply the importance of considering the link between international tax and antitrust policies.

Similar content being viewed by others

1 Introduction

Globalization has led to an increase in not only international trade but also foreign direct investments (FDIs) by firms.Footnote 1 As Neary (2009) pointed out, possible explanations are vertical FDI and cross-border mergers and acquisitions (CM&A) due to the large gains from intrafirm trade of multinational enterprises (MNEs) owing to lower intrafirm trade costs and falls in the acquisition price of a foreign target firm.Footnote 2 The former view is supported by recent evidence showing that a large share of world trade is engaged in related parties of MNEs.Footnote 3 Moreover, the latter indicates an additional driver for CM&A and asymmetric effects of trade liberalization on MNEs’ entry modes. For example, Tekin-Koru (2012) showed tariffs have significantly negative impacts on the likelihood of CM&A but insignificant impacts on that of greenfield FDI (GFDI).Footnote 4 Hence, the interlink between trade liberalization and entry modes into foreign markets can vary across different forms of FDI, and understanding asymmetric effects of trade liberalization on firms’ entry modes is essential for policy discussions.

Among policy discussions, this study examines tax avoidance behaviors by MNEs to obtain new and proper policy implications on international taxation. Recent empirical studies provided ample evidence of MNEs’ profit shifting and one of the globally recognized channels to shift profits is manipulating prices on intrafirm trade, which is also known as abusive transfer pricing.Footnote 5 For example, Cristea and Nguyen (2016), Flaaen (2017), Davies et al. (2018b), Liu et al. (2020) and Wier (2020) showed transfer pricing by MNEs in Denmark, the U.S., France, the UK, and South Africa, respectively. Given the large share of intrafirm trade, trade liberalization is expected to magnify the volume of intrafirm trade and fuel MNEs’ profit shifting via transfer pricing. However, as we argue later in the literature review, most of the literature implicitly assumed GFDI. Therefore, we have limited knowledge regarding how the effects of transfer pricing differ across different modes of FDI, even though CM&A is an equivalently important form of FDI.Footnote 6

Considering tax avoidance under the discussion on firms’ entry mode is important as extant empirical works also provide evidence of the effects of taxes on foreign firms, but their magnitudes differ between different forms of FDI. For example, Hebous et al. (2011) found that CM&A is significantly less elastic to international taxation than GFDI. By focusing on CM&A, Herger et al. (2016) showed vertical FDI is more elastically affected by corporate tax than horizontal FDI. Furthermore, among several papers pointing out the significant impacts of tax avoidance by using tax havens, Meier and Smith (2020) provided evidence that a qualitatively important amount of CM&A is involved with firms in tax havens with a large market, including Ireland and the Netherlands.

Although these findings suggest that forms of FDI are critical for firms’ entry mode and transfer pricing efficiency, the current literature on transfer pricing ignores the choice of GFDI and CM&A. Therefore, some straightforward questions arise. Under which conditions does an MNE prefer CM&A to GFDI? How does trade liberalization affect MNEs’ tax avoidance behavior and entry decisions? This study addresses these questions by considering different degrees of market competition between two entry modes.

In this paper, we extend Bjorvatn (2004) by replacing the tariff-jumping motive of horizontal FDI with its tax-avoidance motive under vertical FDI. A foreign firm headquartered in a high-tax foreign country seeks to enter into a low-tax host country with two local firms using one of the three entry modes: exports, GFDI, or CM&A. Unlike Bjorvatn (2004), we assume that the foreign firm produces its goods in the foreign country even after GFDI and CM&A because intrafirm trade is the source of profit shifting via transfer pricing.Footnote 7 Hence, trade liberalization affects the outputs of firms in all entry modes at different magnitudes due to tax-avoidance efficiency and market structure. Moreover, we introduce the aspect of transfer pricing regulation that makes an MNE’s transfer price manipulation costly.

We find that CM&A is the equilibrium entry mode when transfer pricing regulation is loose, whereas the foreign firm prefers GFDI or exports to CM&A if the regulation is strict enough. The choice between GFDI and exports depends on the size of the fixed costs of GFDI. Intuitively, a loose transfer pricing regulation induces the foreign firm to become an MNE for tax-avoidance benefits; thus a strict transfer pricing regulation increases the likelihood of choosing exports. Moreover, as market competition is less fierce under CM&A, the marginal effect of transfer pricing regulation is stronger under this entry mode. Thus, a sufficiently looser regulation increases the benefits of CM&A and the foreign firm tends to choose it. The finding on the entry mode is empirically supported in the literature, and the result indicates that the degree of transfer pricing regulation is a critical element of an entry mode into foreign markets and some knowledge from the previous literature which ignored CM&A as an entry option may not hold when transfer pricing regulation is loose.

Furthermore, our study also shows that trade liberalization reduces the likelihood of the occurrence of exports but increases that of CM&A. As trade liberalization increases intrafirm trade and thus enhances transfer pricing efficiency, the foreign firm’s incentive to become an MNE increases. This outcome is in line with the empirical evidence that trade liberalization boosts FDI. Moreover, due to less fierce market competition, trade liberalization has greater effects on gains from transfer pricing under CM&A. Thus, our model shows that trade liberalization makes a local firm an attractive target for tax avoidance.

Notably, whether trade liberalization induces GFDI depends on the alternative entry option. As a reduction in trade costs leads to more efficient transfer pricing, it encourages GFDI if the alternative entry mode is exports but discourage GFDI if CM&A is the alternative entry mode. As our results are driven by tax-avoidance motive, this study provides a new rationale for the findings of Tekin-Koru (2012) from the perspective of tax avoidance.

We also briefly argue the role of the transfer pricing regulation and antitrust policies to obtain policy implications, which is another new aspect in the literature. First, as intrafirm trade volume is greater under CM&A than under GFDI due to less fierce competition, profit shifting is a more serious problem under CM&A. As a strict transfer pricing regulation may switch a foreign firm’s entry mode from CM&A to exports or GFDI, tightening transfer pricing regulation impedes tax avoidance via changes in entry modes. Second, as the antitrust authority in the host country may not approve CM&A to protect its consumers, the competition policy could be an alternative policy tool to affect the efficiency of tax avoidance. However, from the viewpoint of welfare in the host country, regulating CM&A implies the host country can receive less shifted profits and hence may be welfare-reducing. These policy-related results suggest the importance of a wider policy discussion on international tax and antitrust policies.

1.1 Related literature

We mainly contribute to the literature of CM&A.Footnote 8 Our study is most related to Bjorvatn (2004) which considers a foreign firm’s entry choice among three options: exports, GFDI, or CM&A. Unlike our setting, Bjorvatn (2004) focused on examining the tariff-jumping motive of horizontal FDI and showed that CM&A is an equilibrium entry mode if the trade costs and/or fixed costs of GFDI is intermediate or large. The reason is simply that a foreign firm chooses exports when trade costs are sufficiently low or prefers GFDI when its fixed costs are low compared with paying the acquisition price for a local firm. Our model provides a sharply contrasting result. We show that a reduction in trade costs decreases the likelihood of exports because it benefits a foreign firm more under intrafirm trade due to tax avoidance. In addition, when transfer pricing regulation is loose, CM&A could be the equilibrium entry mode rather than GFDI as it enhances an MNE’s tax-avoidance behavior because of less fierce market competition. Therefore, the extent of profit shifting is an important determinant of CM&A when firms continue intrafirm trade after becoming an MNE. This finding is a clear message from the current paper.

Several studies also investigated the entry choices, but only a few considered more than three entry choices.Footnote 9 By extending Bjorvatn (2004), Markusen and Stähler (2011) analyzed the entry modes of a foreign firm by incorporating the free entry condition to determine the difference between short- and long-run effects. Markusen and Stähler (2011) showed that in the long run, a foreign firm is less likely to choose acquisition because acquiring a local firm encourages the entry of other local firms, thus decreasing acquisition gains. Mukherjee and Senalp (2021) incorporated the degree of product differentiation and showed the effects of the intensity of market competition on a foreign firm’s entry modes. Cai and Karasawa-Ohtashiro (2018) developed their discussion on a host country’s optimal regulation of entry modes and demonstrated that the regulation leading to CM&A is optimal when the market size is small. Raff et al. (2009) also incorporated joint venture as another entry mode option and showed that a reduction in trade costs can switch a foreign firm’s equilibrium entry mode from CM&A to a joint venture. Qiu (2010) considered a formation of an alliance for logistics or CM&A. Unlike these papers, our paper incorporates tax-avoidance behavior via transfer pricing on intrafirm trade and investigates the impacts of trade costs on the entry mode with an MNE’s tax-avoidance motive.

Our paper also relates to the strand of papers about MNEs’ tax-avoidance behavior.Footnote 10 Although the majority of the papers assumed a fixed location of an MNE, some papers explicitly introduced entry decisions into a foreign market. Bo Nielsen et al. (2008) compared exports with GFDI under different structures of an MNE (a centralized vs. a decentralized MNE) and showed a wider (narrow) tax gap results in a centralized (decentralized) decision as an equilibrium choice of entry. Kato and Okoshi (2019) also considered a firm’s choice between export and GFDI to see the effect of the arm’s length principle of transfer pricing regulation. Bauer and Langenmayr (2013) introduced firm heterogeneity and considered firms’ choice to procure inputs either through GFDI or outsourcing whereas Egger and Seidel (2013) also construct a similar model to Bauer and Langenmayr (2013) and empirically showed an intrafirm trade increase in the tax gap. Unlike these studies, our research is the first to compare three entry modes of foreign markets, including CM&A, and investigate the condition under which an MNE prefers CM&A, which is an ignored but important form of FDI.

Some papers examined CM&A and tax avoidance. Becker and Runkel (2013) compared different international tax systems, namely, separate accounting and formula apportionment methods, to see the incentives of firms’ acquisitions. Bose et al. (2011) analyzed a host country’s regulations on transfer pricing and foreign ownership without market competition. Norbäck et al. (2009) incorporated corporate and capital taxes on CM&A into the model to identify the effects of transfer pricing and deductibility of goodwill on CM&A. However, as these papers ignored exports as an entry mode, the discussion on the effects of trade liberalization on the choices of entry modes has been overlooked.

The rest of the paper is organized as follows. Section 2 describes the model, and Sect. 3 derives the equilibrium and argues the effects of transfer pricing regulation and trade liberalization. In Sect. 4, we present several discussions of our findings, namely, the efficiency of profit shifting, the antitrust policy and robustness of our results. Section 5 concludes.

2 The model

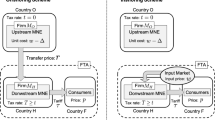

We consider a two country model as illustrated in Fig. 1. We primarily focus on the entry choice of a potential MNE, firm M, headquartered in a high-tax parent country with a corporate tax rate T. Firm M plans to enter the market in a low-tax host country with its corporate tax rate \(t(\le T)\).

The host country has two local firms, namely, firms 1 and 2.Footnote 11 All three firms supply homogeneous goods in the host country. The inverse demand function for the good is given by \(p=a-Q\), where Q is the total supplies. To identify the effects of tax avoidance, we assume that all the firms have the same technology to produce the homogeneous goods with marginal cost c.Footnote 12 Therefore, the objective function of firm \(i\in \{1,2\}\) is

where \(\pi _i\) represents the operating profits of firm \(i\in \{1,2\}\).

Firm M owns a production facility in the parent company. To serve its goods to the host country, the firm has three options: exports, GFDI, and CM&A, labeled by E, G, and A, respectively. Unlike Bjorvatn (2004), we assume that firm M produces its goods in the parent country in all entry modes because of comparative advantage in the parent country. Therefore, firm M needs to incur per unit transport cost \(\tau\) and the tariff-jumping motive of FDI does not exist in the model.Footnote 13 If firm M opts to become an MNE, FDI-specific fixed costs of establishment arise. In the case of GFDI, the establishment costs of a subsidiary such as a distribution branch are denoted by F. In the case of CM&A, firm M needs to pay the acquisition price of a target local firm denoted by V. As explained below, the acquisition price is equivalent to the value of profits that a target firm makes if CM&A is not realized.

Rather than the gains from transport-cost jumping, maintaining intrafirm trade benefits firm M from the viewpoint of tax avoidance. As the parent country is assumed to impose a higher corporate tax than that of the host country (\(t\le T\)), shifting firm M’s profits from the parent country to the host country and reporting more profits in the host country saves firm M’s tax payments. In the current setting, firm M can shift profits via manipulation of transfer price (r) on intrafirm trade. To secure firm M’s positive tax bases in the parent country, we assume that the firm makes exogenously given profits \((\overline{\pi })\) from markets in the parent country.Footnote 14

Transfer price manipulation is the choice of firm M but is costly because of transfer pricing regulation, such as the arm’s length principle. Following the literature such as Bo Nielsen et al. (2008), Egger and Seidel (2013), and Gumpert et al. (2016), we introduce the following costs of transfer pricing:

This cost is referred to as concealment costs because it reflects the costs to hire experts on transfer pricing, such as consultants and lawyers, to avoid tax authorities’ audits or expected penalties being imposed by tax authorities. The concealment costs depend on transfer price and the volume of intrafirm trade \(q_M\) as the more profits are shifted, more likely tax authorities notice such a profit-shifting activity or increase the penalties. Moreover, the cost is in a quadratic form reflecting that the marginal cost of profit shifting increases as the transfer price is more deviated from the true marginal cost of exporting as the arm’s length principle describes. Finally, we interpret \(\delta\) as the strength of enforcement of transfer pricing regulation. Hence, we conduct the comparative statics by checking the changes in \(\delta\) to obtain the policy implication of the current development of tightening transfer pricing.Footnote 15

Given the above features of the setup, firm M maximizes the following post-tax profits,

where \(c_M\equiv (c+\tau )-\frac{(T-t)(c+\tau -r)}{1-t}+\frac{\delta (r-c-\tau )^2}{2(1-t)}\) represents tax-adjusted marginal cost. Based on the true marginal supply cost captured by the first parenthesis, the tax-adjusted marginal cost \(c_M\) is composed of two additional motives. First, by lowering the transfer price than the true marginal supply costs \(r<c+\tau\), firm M can save marginally \(\frac{T-t}{1-t}\) amounts of tax payments. Because this saving is based on intrafirm trade volume, the tax-adjusted marginal cost includes the tax benefits, which is captured by the second term. Moreover, due to concealment costs, such tax gains are weakened as captured by the third term. Putting all the tax adjustment terms together, firm M determines its supply decision and regards \(c_M\) as its marginal cost in market competition.

We solve the following two-stage game. First, firm M chooses its entry mode among the three schemes \(s\in \{E, G, A\}\). Without loss of generality, firm 2 is assumed to be the target firm in the case of CM&A. Note that, if firm M chooses CM&A, it offers the acquisition price which induces the target firm to take. At the second stage, given the entry mode, firms compete in a Cournot fashion and firm M determines transfer price if it chooses to be an MNE.Footnote 16 We solve the game by backward induction in Sect. 3.

3 Equilibrium

Given the above maximands of firms, we first derive the equilibrium outputs as in a standard Cournot competition with tax-adjusted marginal cost for GFDI and CM&A. For notational brevity, we use \(\alpha \equiv a-c\) in the following computation.

The local firms’ decisions on their supplies are based on the first-order condition \(\frac{\partial \Pi _i^s}{\partial q_i^s}=(1-t)\left\{ (p-c)+q_i^s\frac{\partial p}{\partial q_i^s}\right\} =0\) where \(i\in \{1,2\}\) and \(s\in \{E,G,A\}\). When firm M chooses exports, its first-order condition is \(\frac{\partial \Pi _M^E}{\partial q_M^E}=(1-T)\left\{ (p-c)+q_M^E\frac{\partial p}{\partial q_M^E}\right\} =0\), and the firms produce the following set of outputs,

In the case of either GFDI or CM&A, the centralized MNE designs transfer price and its amount of supplies to maximize the post-tax profits,

where \(s\in \{G,A\}\). The first equation shows that the optimal transfer price is lower than the true marginal costs by the tax-avoidance motive captured by the last term, which is well-known as in the literature such as Egger and Seidel (2013). The transfer price is further lower as the tax gap is wider or transfer pricing regulation is loose, namely, \(\frac{\partial \widehat{r}}{\partial (T-t)}<0\) and \(\frac{\partial \widehat{r}}{\partial \delta }>0\), because larger gains from tax avoidance and smaller costs of transfer pricing magnify firm M’s incentive to shift profits by lowering its transfer price. Notably, the optimal transfer price is independent from the forms of FDI. The optimal transfer price pins down the tax-adjusted marginal costs in the equilibrium as

As the optimal transfer price is lower under a wider tax gap or looser transfer pricing regulation, the tax-adjusted marginal cost is subsequently lower due to the gains from tax avoidance.

With the optimal transfer price, we can derive the following equilibrium outputs under GFDI and CM&A, respectively,

Firm M’s outputs increase with a tax gap, \(\frac{\partial \widehat{q}_M^s}{\partial (T-t)}>0\), and decrease with transfer pricing regulation, \(\frac{\partial \widehat{q}_M^s}{\partial \delta }<0\), as intrafirm trade is associated with profit shifting. For the same reasons, local firms’ supplies decrease with the tax gap, \(\frac{\partial \widehat{q}_L^s}{\partial (T-t)}<0\), and increase with transfer pricing regulation, \(\frac{\partial \widehat{q}_L^s}{\partial \delta }>0\).

In the first stage, if firm M plans to conduct CM&A, the owner of firm 2 decides whether to take firm M’s offer or not depending on the size of the acquisition price V. If V is less than the profits of firm 2 under an alternative scheme \(s=\{E, G\}\), then firm 2 denies the offer. Specifically, firm 2 takes the offer if

where \(\Pi _L^s=\Pi _2^s\left( =\Pi _1^s\right)\) holds under \(s\in \{E,G\}\). Thus, firm M’s optimal offer to acquire firm 2 satisfies the equality of Eq. (3).

With the acquisition price, let us consider firm M’s optimal choice of entry mode. First, as the acquisition price is determined by the alternative entry scheme, the condition when exports make greater post-tax profits than GFDI and vice versa must be identified. By comparing \(\Pi _M^E\), and \(\Pi _M^G\), we have the thresholds of F such that \(\Pi _M^E = \Pi _M^G\),

Hence, firm M chooses GFDI over exports if the fixed costs of GFDI are lower than \(\underline{F}^E\) and prefers exports to GFDI otherwise. Intuitively, when the gain from tax avoidance is large, the likelihood of firm M to choose GFDI increases as well as the threshold. Formally, \(\frac{\partial \underline{F}^E}{\partial \delta }<0\) holds. Thus, the stricter transfer pricing regulation, captured by an increase in \(\delta\), makes exports a more attractive option because it reduces tax avoidance gains by becoming an MNE.

Hereinafter, we investigate the profitability of CM&A. First suppose \(F<\underline{F}^E\) holds and GFDI is the alternative scheme. As firm M needs to pay \(V=\Pi _L^G\) to conduct CM&A, CM&A is profitable if

holds. Similar to \(\underline{F}^E\), firm M prefers GFDI to CM&A when the fixed costs of GFDI are smaller than \(\underline{F}^A\). Notably, \(\frac{\partial \underline{F}^A}{\partial \delta }>0\) is confirmed, indicating that a strict transfer pricing regulation makes CM&A less likely to be chosen. Behind the sign, there are two opposing effects. On the one hand, as shown in \(\frac{\partial q_M^G}{\partial \delta }<\frac{\partial q_M^A}{\partial \delta }(<0)\), firm M reduces the outputs more under GFDI than under CM&A because of more local competitors. This situation discourages firm M to engage in GFDI. On the other hand, a strict regulation increases the target firm’s supply under GFDI, \(\frac{\partial q_L^G}{\partial \delta }>0\), therefore increasing the acquisition price. Thus, our result shows that the latter effect dominates the former effect and that tightening the transfer pricing regulation makes CM&A a less attractive entry mode.

Next, suppose \(\underline{F}^E<F\) holds and export is the alternative scheme. As firm M needs to pay \(V=\Pi _L^E\) to conduct CM&A, CM&A is profitable if

holds. Note that when \(\xi <0\) holds, \(\left( \Pi _M^A-\Pi _L^E\right) - \Pi _M^E>0\) holds even without profit shifting, \(\delta =\infty\). Formally, \(\xi <0\) holds if \(t+\frac{2(1-t)(\alpha +\tau )(\alpha +13\tau )}{9(\alpha -3\tau )^2}<T\) holds.Footnote 17 Without profit shifting, firm M can still save tax because its operating profits are subject to a lower tax rate t only after becoming an MNE. Hence, when the parent country imposes a high tax, CM&A is profitable. To focus on the role of transfer pricing, we assume \(\xi >0\) hereafter.

Even if \(\xi >0\) holds and the parent country imposes a moderate tax rate \(T<t+\frac{2(1-t)(\alpha +\tau )(\alpha +13\tau )}{9(\alpha -3\tau )^2}\), firm M may prefer CM&A because transfer pricing provides additional benefits to the firm as shown in the second and third terms of Eq. (4). Specifically, we have

Intuitively, a looser transfer pricing regulation magnifies the tax avoidance benefits under CM&A; thus, CM&A is likely profitable compared with exports.

The above result is drawn in Fig. 2 and summarized as the following proposition,Footnote 18

Proposition 1

Firm M chooses export when \(\underline{\delta }^E<\delta\) and \(\underline{F}^E<F\) hold whereas it prefers GFDI when \(F<\min \{ \underline{F}^A, \underline{F}^E\}\) holds. Otherwise, the equilibrium entry mode is CM&A.

Note that the above equilibrium entry mode is tax-motivated. By substituting \(T=t\) into the thresholds, we have \(\left. \Pi _M^E - \Pi _M^G\right| _{T=t}>0\), and \(\left. \left( \Pi _M^A-\Pi _L^E\right) - \Pi _M^E\right| _{T=t}=-2(1-t)(\alpha +\tau )(\alpha +13\tau )<0\) due to the fixed cost of GFDI and an increase in nontarget firm’s market power which is known as the business stealing effect in the literature about M&A. This means exports are the equilibrium entry mode without any tax gap, and, therefore, the tax-saving opportunity is a source of FDI. Note that the tax saving opportunity includes the combination of a low tax rate in the host and tax avoidance via transfer pricing. We can disentangle the two effects by considering an extreme case with \(\delta \rightarrow \infty\). Under such an extremely high \(\delta\), transfer pricing is impossible and the latter change of tax saving disappears. Subsequently, given the assumption \(\xi >0\), we have \(0<\underline{F}^E<\underline{F}^A\) and \(\left. \left( \Pi _M^A-\Pi _L^E\right) - \Pi _M^E\right| _{T=t}=-\xi <0\), which means that GFDI can be the equilibrium entry mode but CM&A is not the entry mode in equilibrium without transfer pricing.Footnote 19 The reason is because the business stealing effect reduces the gains from CM&A and GFDI is profitable to face a low tax rate in the host country. Therefore, transfer pricing is the driver of CM&A.

The proposition provides new insights into how the transfer pricing regulation and an MNE’s foreign entry mode are related. As CM&A is the equilibrium entry mode when the transfer pricing regulation is loose, tightening transfer pricing discourages a foreign firm to merge with a local firm in a host country. This result is in line with empirical evidence as shown in Prettl and von Hagen (2023) investigating a specific type of transfer pricing regulation, that is, controlled foreign corporation rules.Footnote 20 In reality, the quality of institutions in developing countries tends to be lower than that in developed countries. This difference indicates that developing countries are likely to have a looser regulation. Furthermore, as in the introduction, Meier and Smith (2020) mentioned a large amount of CM&A in tax havens with large markets where transfer pricing regulation is loose. Thus, a foreign firm is more likely to enter a developing country or tax havens with a large market via CM&A.Footnote 21

Moreover, the proposition also indicates that we should pay careful attention to the effects of tightening the transfer pricing regulation, which has been pointed out in the extant literature. Similar to our setting, some studies also analyzed such effects given that the mode of foreign entry is fixed as GFDI. However, as our result shows, a foreign firm may prefer CM&A to GFDI when the transfer pricing regulation is loose. Thus, if CM&A is a realistic alternative option in reality, then some results in the literature may be changed.

3.1 Trade liberalization

As pointed out and empirically showed by Hijzen et al. (2008) and Tekin-Koru (2012), the impacts of trade liberalization on entry modes are asymmetric and still in question. In this subsection, we argue the effects of trade liberalization captured by a reduction in \(\tau\) on the three thresholds of entry mode.

As shown in “Appendix 1”, we obtain the following proposition as illustrated in Fig. 3.

Proposition 2

An decrease in transport costs increases \(\underline{F}^E\) and \(\underline{\delta }^E\), but decreases \(\underline{F}^A\).

The proposition states that trade liberalization increases the likelihood of CM&A but decreases that of exports. The results are interpreted as follows. A reduction in transport costs increases the exports of firm M irrespective of the entry forms. However, the magnitude of the benefits varies between entry modes. Compared with exports, the benefits are greater when firm M becomes an MNE either via GFDI or CM&A due to tax-avoidance gains. Moreover, as trade liberalization reduces the acquisition price of the local firm \(V=\{\Pi _L^E,\Pi _L^G\}\), a reduction in trade costs increases firm M’s profits more under CM&A than under GFDI.Footnote 22 Hence, as shown in Fig. 3, trade liberalization induces firm M to choose CM&A over exports and GFDI in the slashed area, represented as the state \(S_{EA}\) and \(S_{GA}\), whereas it chooses GFDI over exports in the dotted area, represented as the state \(S_{EG}\).Footnote 23

The result is in line with the boosts of FDI in the last three decades and with the findings in empirical studies. Hijzen et al. (2008) concluded that trade costs negatively affect CM&A. Tekin-Koru (2012) also empirically showed that tariffs have significantly negative impacts on the likelihood of CM&A and insignificant impacts on that of GFDI.Footnote 24 As represented by the state \(S_{GA}\) and \(S_{EG}\), the ambiguous effects of trade costs stem from the alternative entry mode of GFDI.

Notably, a switch of firm M’s entry decision from exports to GFDI increases the volume of exports as well. Specifically, we have \(\widehat{q}_M^E<\widehat{q}_M^G\) and

Hence, our model shows a simultaneous expansion of international trade and FDI if trade liberalization changes firm M’s entry mode. As a tax gap is a source of FDI in our model, tax-motivated FDI entails more intrafirm trade, which is a new rationale for the recent development of FDI and international trade.

4 Discussion

So far, we examined the equilibrium entry modes into a host market and the effects of the tightening transfer pricing regulation and trade liberalization. In this section, we briefly explore the impacts of a strict transfer pricing regulation on the efficiency of tax avoidance and of the antitrust regulation on welfare in the host country. Furthermore, we argue for the robustness of our main results by relaxing certain assumptions.

4.1 Efficiency of profit shifting

As our model incorporates an MNE’s transfer pricing under different entry modes, comparing and understanding the efficiency of tax avoidance under CM&A and GFDI is useful to obtain policy implications. In the setup, the MNE’s decision making is assumed to be centralized. This assumption makes the same levels of transfer price under CM&A and GFDI, \(\widehat{r}=c+\tau -\frac{T-t}{\delta }\). Therefore, the comparison of intrafirm trade volume is sufficient to check the efficiency of profit shifting.

From Eq. (5), we can confirm \((\widehat{q}_M^E\le )\widehat{q}_M^G<\widehat{q}_M^A\). Therefore, irrespective of the degree of the transfer pricing regulation, the intrafirm trade volume under CM&A is greater. Consequently the efficiency of profit shifting under CM&A is also higher compared with GFDI. This result again stems from the degree of market competition and a smaller numbers of operating firms under CM&A that expand the remaining firms’ output per firm, although less fierce market competition decreases the total supplies. Hence, due to the change in market structure, profit shifting is more serious when it is easy to conduct and a foreign firm enters a host market via CM&A.

This implies a new role of the transfer pricing regulation in fighting against an MNE’s tax-avoidance behavior. Tightening the transfer pricing regulation is often expected to prevent an MNE’s tax avoidance by making it difficult for an MNE to deviate the transfer price from the true marginal cost. However, our model predicts that a strict transfer pricing regulation lowers the efficiency of profit shifting by changing an MNE’s entry choice from CM&A to exports or GFDI.Footnote 25

4.2 Antitrust policy

Another discussion related to CM&A is how it affects welfare in a host country. Recall that our model suggests that exports or GFDI are the equilibrium entry mode when profit shifting is difficult to achieve. Hence, given the hot discussion on MNEs’ tax-avoidance behavior under trade liberalization, our result indicates the importance of considering CM&A when we argue anti-tax-avoidance policies or the antitrust regulation.

In reality, whether a country approves M&A is a sensitive discussion because M&A may hurt consumers due to an increase in firms’ market power. Thus, the antitrust authority may regulate CM&A. In this subsection, we consider the incentives of the antitrust authority to deny the CM&A and how the decision affects welfare in the host country to obtain implications on the antitrust policy with an MNE’s tax-avoidance motive.

Following the literature on industrial organization, we assume that the antitrust authority makes its decision based on the consumer surplus rather than welfare in the host country. Let \(Q^s\) be the total amount of supplies under scheme \(s\in \{E, G, A\}\). In addition, suppose firm M initially supplies the goods via export and an external shock such as investment liberalization triggers GFDI and CM&A as other options for its entry mode. Then, the antitrust authority in the host country does not allow CM&A if the total supplies decrease after CM&A, that is,

holds.Footnote 26 Figure 4 illustrates the effect of the antitrust policy, and the equilibrium entry mode changes into the alternative scheme. The existence of the threshold \(\underline{\delta }^Q\) is based on the two opposing effects. On the one hand, CM&A increases firms’ market power and tends to reduce the total outputs. On the other hand, firm M’s output is also driven by the tax avoidance motive, thus increasing its outputs. As lower \(\delta\) magnifies the latter effect, the total outputs under low \(\delta\) resulting in CM&A increase compared with the case of exports.

We clarify that such an antitrust policy regulating CM&A always contributes to less efficiency of tax avoidance. In the case of exports, firm M has no profit-shifting opportunities. In addition, in the case of GFDI as an alternative scheme, the last subsection showed the smaller intrafirm trade volume under GFDI; thus, fewer profits are shifted from the parent country to the host country. Hence, we can expect the role of the antitrust policy not only in protecting consumers in the host country but also in preventing an MNE from avoiding tax payments.

4.2.1 Welfare in the host country

From the viewpoint of the host country, opposing welfare effects from CM&A regulation emerge. Regulating CM&A benefits consumers but reduces tax revenues from firm M because firm M has no subsidiary in the host country in the case of exports or has less efficient opportunities for profit shifting in the case of GFDI. Hence, CM&A in the model does not necessarily indicate a decrease in welfare in the host country, and as argued in the previous subsection, regulating CM&A may reduce welfare in the host country.

To see the above possibility, we conduct a welfare analysis. Let \(W^s\) be welfare in the host country, which is composed of consumer surplus (\(CS^s\)), the sum of local firms’ profits (\(\sum \pi _L^s\)), and tax revenue from firm M or, specifically, \(W^s=CS^s+ \sum \pi _i^s+t(p-r)q_M^s\).

As in “Appendix 2”, the following proposition is obtained.

Proposition 3

(i) There exists a threshold \(\delta ^{GA}\), below which, \(W^G<W^A\) holds when \(t^{GA}<t<T\) holds; otherwise \(W^A\le W^G\) always holds. (ii) In addition, exports lead to greater welfare than GFDI when \(\delta _{GE}<\delta <\delta ^{GE}\) holds, and \(W^E<W^A\) holds otherwise. (iii) Moreover, there exists a unique threshold \(\delta _{AE}\) (two thresholds \(\delta _{AE}\) and \(\delta ^{AE}\)), which satisfies \(W^A=W^E\) and \(W^A<W^E\) holds under \(\delta _{AE}<\delta\) (\(\delta _{AE}<\delta <\delta ^{AE}\)) when \(t^{AE}<t\) (\(t<t^{AE}\)) holds; otherwise, \(W^E<W^A\) holds. (iv) In particular, if \(t<\min \{t^{GA}, t^{AE}\}\) holds; the order of the thresholds \(\delta _{AE}<\delta _{GE}<\delta ^{GE}<\delta ^{AE}\) holds whereas \(t^{AE}<t<t^{GA}\) secures the following order of the three thresholds \(\delta _{AE}<\delta _{GE}<\delta ^{GE}\).

Proposition 3 shows several welfare patterns in the host country, depending on the combination of the tax rate in the host country and the extent of transfer pricing regulation. The first statement in the proposition points out the possibility that CM&A is desirable compared to GFDI when a tax rate in the host country is relatively large and transfer pricing regulation is loose. The reason is that as CM&A allows more inflows of firm M’s tax base into the host country, a high-tax rate in the host country magnifies the benefits of an increase in tax revenue. Although consumer surplus and profits of local firms are included in its welfare, most of the supplies are contributed by firm M; thus, these impacts on welfare are not the main effects. In contrast, GFDI is more desirable than CM&A due to stronger market concentration, which reduces consumer surplus under CM&A.

This provides an important policy implication on antitrust authority’s decision when the alternative scheme is GFDI. Recall that, if antitrust authority’s decision is based on consumer surplus, its decision is always to regulate CM&A. However, under \(\underline{\delta }^{min}<\delta <\delta ^{GA}\), CM&A leads to greater welfare than GFDI, which means that regulating CM&A is welfare-reducing. Therefore, this finding implies that it is crucial for antitrust authorities to take international tax issues into account, especially when MNEs’ transfer pricing is easy to conduct.

Furthermore, the second statement of Proposition 3 means whether GFDI leads to greater welfare compared to exports also depends on the level of transfer pricing regulation. If the regulation is loose, the host country’s benefits from transfer pricing are large and dominates losses of local firms’ profits due to an increase in tax revenue and consumer surplus due to fiercer market competition. Under an intermediate extent of transfer pricing regulation, however, such benefits and losses become smaller at different magnitudes, and it is possible that the dominant effect is a reduction in local firms’ profits. Therefore, welfare under exports is greater than that under GFDI. With a stricter enforcement of transfer pricing regulation, GFDI is preferable for exports as such an environment does not allow a large deviation of transfer pricing from the marginal export cost and does not affect market outcomes much, although the MNE has to pay its tax in the host country.

Regarding the third point of Proposition 3, the aforementioned argument is also applicable to the comparison between CM&A and exports with one difference, that is, less fierce market competition in the host country. As the number of firms in the market decreases under CM&A, consumer surplus is likely to become small compared to the other two schemes. Therefore, if the host country imposes a relatively high-tax rate, its deviation of transfer price from the marginal export costs is small and the beneficial aspects of transfer pricing is small, which allows a unique threshold \(\delta _{AE}\) because consumer loss from an increase in market concentration is a dominant effect.

Figures 5 and 6 illustrate numerical examples of the welfare patterns with different levels of transport cost and different tax gaps.Footnote 27 The left figures represent the case of large transport costs with \(\tau =0.33\) whereas the right figures represent the case with \(\tau =0.2\) after trade liberalization. In Fig. 5, two thin vertical lines show thresholds such that \(\delta ^{GA}\) and \(\delta _{AE}\) hold, respectively. As statement (i) of Proposition 3 describes, a narrow tax gap shows a range of cases with the welfare order \(W^A>W^G(>W^E)\) as shown in Fig. 5; however, a wide tax gap does not generate such cases as shown in Fig. 6. As argued above, regulating CM&A with GFDI as the alternative scheme is welfare-reducing under loose transfer pricing regulation, which is drawn in the shaded area. Moreover, as in the statement of (ii) in Proposition 3, above the threshold of \(\delta ^{GE}\approx 1.84\), the welfare order \(W^E>W^G>W^A\) holds, which is outside the figure.

Beyond Proposition 3, the figures show additional insights into the welfare effects of regulating CM&A by focusing on the welfare orders between CM&A and exports (\(W^A\) vs \(W^E\)). From the figures, the orders of the three thresholds \(\underline{\delta }^Q\), \(\underline{\delta }^E\) and \(\delta _{AE}\) depends on the parameter values, which implies that whether regulating CM&A is beneficial is inconclusive. Only in the left figure of Fig. 6, \(\delta _{AE}<\underline{\delta }^Q<\underline{\delta }^E\) holds whereas the other figures show \(\underline{\delta }^Q<\delta _{AE}<\underline{\delta }^E\). As an intermediate transfer pricing regulation generates welfare losses due to relatively small consumer benefits and a small increase in tax revenue, regulating CM&A improves welfare in the host country when \(\delta _{AE}<\delta <\underline{\delta }^E\) holds. However, under \(\underline{\delta }^Q<\delta <\delta _{AE}\), regulating CM&A is detrimental for the host country if the alternative scheme is exports due to the lost opportunity to receive firm M’s inflows of the tax base and consumer benefits from a low transfer price. Such cases of welfare-reducing M&A regulation correspond to the slashed area. In other words, regulating CM&A is welfare-enhancing if \(\delta _{AE}<\delta <\underline{\delta }^E\) holds but welfare-reducing if \(\underline{\delta }^Q<\delta <\delta _{AE}\) holds.

4.3 Robustness

The main analysis showed the conditions for the equilibrium entry mode and the effects of trade liberalization, that is, more likelihood of CM&A, less likelihood of exports and ambiguous effects on GFDI. This subsection argues about the robustness of the results by considering other modifications.

4.3.1 Heterogeneous firms

We made an assumption of homogeneity on marginal costs for the sake of simplicity to point out the main results. Although this modification does not change the main findings of the study, it provides an additional insights into which local firm is the target firm. The detail calculations are in “Appendix 3”.

Suppose firm M is the most productive firm, which is in line with the empirical literature such as Helpman et al. (2004), whereas firm 2 is the least productive firm without loss of generality. Specifically, we assume \(c_M=0<c_1=\gamma c<c_2=c\) where \(\gamma \in (0,1]\) is a parameter that captures the productivity gap between the local firms. Whether firm M prefers merging with a less productive firm to a merger with a productive firm is ambiguous. On the one hand, firm M may choose a less productive firm 2 for its target firm because the acquisition price on the firm is lower. On the other hand, a merger with a productive local firm 1 may be profitable for firm M because the remaining competitor is less productive and firm M’s profits after the merger are larger than in the case of merging with less productive firm 2.

In “Appendix 3”, we show that looser transfer pricing regulation induces firm M to merge with productive firm 1 whereas firm M prefers a merger with less productive firm 2 under a stricter regulation of transfer pricing. The intuition is as follow. Under a loose enforcement of transfer pricing regulation, firm M’s transfer price is quite low and firm M wants to keep less productive firm 2 as its competitor because higher intrafirm trade after a merger allows higher profit shifting. Thus, in an environment in which firm M easily manipulates its transfer price, productive firm 1 is the target firm. However, a stricter transfer pricing regulation reduces such gains from profit shifting. Furthermore, an important factor to choose its target firm for CM&A is the lower acquisition price for a merger, meaning that firm 2 is the target firm for CM&A. Regarding the impacts of trade liberalization, a reduction in trade costs magnifies the tax-avoidance effects and, therefore, it is more likely for firm M to choose productive firm 1 as its target firm to merge with.

4.3.2 Bertrand competition

We finally argue the modification of the model with price competition among firms instead of quantity competition. To explore the Bertrand model of competition, we introduce differentiated products; therefore, the merged entity continues the production of both firms and maximizes its joint profits. With the modification, again, we confirmed the equilibrium entry modes of CM&A and exports and the impacts of trade liberalization on the entry decision.

One different result from the Cournot setting is that GFDI may be no longer the equilibrium entry mode in the Bertrand model of competition. This is due to a feature of strategic complement in the Bertrand competition rather than that of strategic substitute in Cournot competition. Under price competition, firm M’s optimal price is a function of firm M’s tax-adjusted marginal cost \(c_M\) which decreases with its tax-avoidance activity and, equivalently, the tax gap between countries. Under CM&A, firm M sets the price of its own product is higher than the case under GFDI as it takes the profits from the differentiated product of the target firm, which is known as the cannibalization effect. Such an increase in price mitigates market competition and subsequently induces increases in prices of goods 1 and 2. Due to the gains from mitigated market competition stemming from strategic complement, GFDI is less likely to be the equilibrium entry mode compared to the case of Cournot competition.

5 Concluding remarks

With the progress of globalization, the simultaneous development of international trade and FDI inflows has been observed. As a large share of international trade is intrafirm trade, the importance of analyzing MNEs’ tax avoidance has grown. Notably, empirical evidence shows asymmetric impacts of trade costs on MNEs’ entry decision. Despite the importance of exploring tax avoidance by MNEs with different forms of FDI, the extant literature ignored CM&A. The current paper has scrutinized the choices of a foreign firm to enter into a host country between exports, GFDI or CM&A from the viewpoint of tax avoidance via transfer pricing.

The model showed that CM&A is profitable when the transfer pricing regulation is loosely conducted, whereas GFDI (exports) is profitable when the extent of transfer pricing regulation is strict and the fixed costs of establishing a subsidiary are low (large). Under CM&A, an MNE can shift more profits across countries because less fierce market competition increases intrafirm trade; thus, tax-avoidance gains are greater than that under GFDI. Moreover, we showed that trade liberalization increases the likelihood of CM&A and decreases that of exports. Therefore, a foreign firm regards a local firm as an attractive target of CM&A for tax avoidance. The reason is that a reduction in trade costs reduces an acquisition price of a local target firm and increases tax-avoidance gains due to an increase in intrafirm trade. Moreover, the model also found that the impact of trade liberalization is ambiguous and depends on an alternative entry mode of GFDI. These findings are in line with the growth of FDI and with recent empirical findings.

Furthermore, based on the analysis, we argued two new policy implications. First, as intrafirm trade is greater under CM&A than under GFDI, a change in entry mode from CM&A to GFDI due to tightening the transfer pricing regulation prevents an MNE from avoiding tax payments. Thus, a strict transfer pricing regulation is expected to be an effective policy tool to fight against MNEs’ profit shifting by affecting the entry form as well as by regulating transfer pricing manipulation.

In addition to international tax policies, the analysis has also covered the antitrust policy for regulating CM&A. The results showed that the antitrust authority denies CM&A when the degree of transfer pricing regulation is intermediate. The reason is that, under a loose transfer pricing regulation, the total supplies in the host country under CM&A are greater than those under export because the tax-avoidance motive increases intrafirm trade. This positive impact outweighs the negative impact due to an increase in market power. Hence, at the low level of the transfer pricing regulation, the optimal entry mode for an MNE is CM&A. Nevertheless, under an intermediate regulation, the tax motive cannot cover the negative impacts of less fierce market competition. Notably, such a decision to regulate CM&A does not always improve welfare because CM&A induces an MNE to shift profits and the host country receives more tax base. Our numerical example shows the case where the denial of CM&A can be welfare-reducing. It indicates that considering tax aspects becomes important when one argues approval of CM&A, although consumers’ losses are traditionally the main point of discussion to approve an M&A.

Although our study provided a set of new results and policy implications, further research is required to understand FDI in a globalized economy. First, as some papers identified that tax avoidance and/or the effects of entry modes on firms’ outcome substantially differ across industries. For example, tax-avoidance behavior is intensely observed in R&D intensive industries (Davies et al., 2018b) whereas CM&A inspires but GFDI does not affect acquiring firms’ R&D activities (Stiebale, 2013). Thus, incorporating such an investment phase in the game may be an important extension. Moreover, as the current paper mainly focused on firm’ entry decision, we simplified the policies. However, we observe various policies in international tax policies such as the arm’s length principle or patent box. Thus comparing different types of transfer pricing regulation is helpful to understand the efficiency of profit shifting. Finally and most importantly, an empirical investigation by clarifying the difference between CM&A and GFDI is essential. These directions of extension remain as future research.

Notes

The simultaneous expansions of firms’ activities were considered as a puzzle a few decades ago when most of FDIs were horizontal FDI. One of the well-known benefits from horizontal FDI is the avoidance of trade costs, which is known as the tariff-jumping motive. Thus, trade liberalization encourages firms to conduct international trade but discourages them to conduct FDI. This trade-off is also known as the “proximity concentration trade-off.”

For example, Bernard et al. (2010) and Lanz and Miroudot (2011) showed that over 46% of United States (U.S.) imports in 2000 and 50% of imports to the U.S. in 2009 were intrafirm trade. Furthermore, according to Miroudot and Rigo (2022), approximately two-thirds of world exports are involved with MNEs’ production networks.

See Beer et al. (2020) for a recent survey of MNEs’ tax avoidance behavior.

According to UNCTAD’s estimates, CM&A was 43% of the total value of worldwide FDI outflows in 2021. See https://unctad.org/system/files/official-document/wir2022_overview_en.pdf.

We can potentially two additional options for the foreign firm’s entry decisions, namely, GFDI and CM&A with production in the host country. However, introducing them as the foreign firm’s strategies do not provide additional insights; instead, it makes the analysis complicated. Intuitively, when a foreign firm conducts GFDI or CM&A, whether it produces its goods in the headquartered country or in the host country depends on the comparison of gains from tariff jumping and tax avoidance. As large trade costs increase the gains from tariff jumping, the foreign firm prefers FDI with production in the host country; otherwise, it prefers production in the home country otherwise. In other words, we implicitly assume intermediate or low trade costs, whereas Bjorvatn (2004) focused on the case of large trade costs.

Most of the papers analyzed wholly owned MNE’s profit-shifting strategies, though Gabrielsen and Schjelderup (1999) and Schindler and Schjelderup (2012) considered another ownership structure. Gabrielsen and Schjelderup (1999) analyzed the transfer pricing of a jointly owned MNE and Schindler and Schjelderup (2012) also considered partial ownership but focused on internal debt shifting rather than transfer pricing on tangible assets.

This is the simplest setup to highlight the mechanisms and results of the study. The qualitative result holds even if we introduce n local firms, which is shown in the Online Appendix 1.

We relax this assumption of homogeneous firms in Sect. 4.3.1.

We assume \(\tau <\frac{a-c}{3}\equiv \tau ^{max}\) to secure positive outputs of all firms.

One might question the assumption of exogenous profits in the parent country as trade liberalization might induce more foreign firms to enter the parent country market via exports or encourage more domestic firms to start their business due to acess to cheaper inputs from abroad. However, such potential impacts on the home market do not affect firm M’s entry decision because its decision is based on the comparison of profits in the host country across entry modes and the profits from the parent country are independent.

As explained in Sect. 3, the tax-avoidance opportunity encourages firm M to expand its production due to lower tax-adjusted marginal costs. This situation implies that local firms’ outputs may be non-positive under certain conditions. We assume away such cases and focus on the case with \(\underline{\delta }^{min}\equiv \frac{(T-t)^2}{2(1-t)(\alpha +\tau )}<\delta\), where all firms’ outputs are non-negative.

We discuss the robustness of the results by considering the Bertrand competition in Sect. 4.3.2.

This condition is possible only when \(\tau <\frac{A}{11}\) holds.

In Fig. 2 “Export” and “GFDI” in the parenthesis under “CM&A” indicate the alternative scheme.

Formally, we have \(\underline{F}^A-\underline{F}^E=\frac{9(1-T)(\alpha -3\tau )^2-(1-t)(7\alpha -5\tau )(\alpha -11\tau )}{72}>0\) because the assumption of \(\xi >0\) requires \(\frac{A}{11}<\tau\).

By focusing on GFDI rather than CM&A, Clifford (2019) also concluded that controlled foreign corporation rules cause MNEs to locate fewer subsidiaries in low-tax countries.

This mechanism about the acquisition price is already mentioned by Neary (2009) and is not new in the literature. Transfer pricing magnifies the mechanism via the tax-adjusted marginal cost.

We use \(S_{ab}\) for the combination of \((F, \delta )\) before trade liberalization is \(a \in \{E,G,A\}\) and after that is \(b \in \{E,G,A\}\). Therefore, the first and second subscripts show the equilibrium entry mode before trade liberalization and after a reduction in trade costs, respectively.

See Table 5 in Tekin-Koru (2012). Unlike our results, Table 6 in Tekin-Koru (2012) also showed a significantly negative effect of tariffs on the likelihood of exports. One possible reason is that lower transport costs may induce new entrants via exports. In the literature of FDI, such as Melitz (2003), trade liberalization is well-known to induce less productive firms to enter foreign markets via exports, which we cannot argue due to the fixed number of foreign firms.

Similarly, Kato and Okoshi (2019) pointed out the location change mechanism by considering input location choices and showed that the arm’s length principle encourages an MNE to gather its production plants in a host country and eliminate intrafirm trade.

One may speculate whether the antitrust authority determines its decision based on the total supplies under CM&A and those under the alternative scheme rather than those under exports. This modification always induces the antitrust authority to regulate CM&A if the alternative scheme is GFDI.

We use the following parameter values: \(a=1.5\), \(c=0.25\), \(\gamma =0.8\), \(T=0.25\), and \(t=0.1\).

The following parameter values are used: \(a=1.5\), \(c=0.5\), \(\beta =0.25\), \(T=0.25\), and \(t=0.25\).

References

Bauer, C. J., & Langenmayr, D. (2013). Sorting into outsourcing: Are profits taxed at a gorilla’s arm’s length? Journal of International Economics, 90, 326–336.

Becker, J., & Runkel, M. (2013). Corporate tax regime and international allocation of ownership. Regional Science and Urban Economics, 43, 8–15.

Beer, S., De Mooij, R., & Liu, L. (2020). International corporate tax avoidance: A review of the channels, magnitudes, and blind spots. Journal of Economic Surveys, 34, 660–688.

Bernard, A. B., Jensen, J. B., Redding, S. J. & Schott, P. K. (2010). Intra-firm trade and product contractibility (long version).

Bjorvatn, K. (2004). Economic integration and the profitability of cross-border mergers and acquisitions. European Economic Review, 48, 1211–1226.

Bo Nielsen, S., Raimondos-Møller, P., & Schjelderup, G. (2008). Taxes and decision rights in multinationals. Journal of Public Economic Theory, 10, 245–258.

Bose, G., Dasgupta, S., & Ghosh, A. (2011). Cross-border acquisitions and optimal government policy. Economic Record, 87, 427–437.

Cai, D., & Karasawa-Ohtashiro, Y. (2018). Greenfield, merger and acquisition, or export? Regulating the entry of multinational enterprises to a host-country market. International Review of Economics and Finance, 56, 397–407.

Clifford, S. (2019). Taxing multinationals beyond borders: Financial and locational responses to CFC rules. Journal of Public Economics, 173, 44–71.

Collie, D. R. (2011). Multilateral trade liberalization, foreign direct investment and the volume of world trade. Economics Letters, 113, 47–49.

Cristea, A. D., & Nguyen, D. X. (2016). Transfer pricing by multinational firms: New evidence from foreign firm ownerships. American Economic Journal: Economic Policy, 8, 170–202.

Davies, R. B., Desbordes, R., & Ray, A. (2018). Greenfield versus merger and acquisition FDI: Same wine, different bottles? Canadian Journal of Economics/Revue canadienne d’économique, 51, 1151–1190.

Davies, R. B., Martin, J., Parenti, M., & Toubal, F. (2018). Knocking on tax haven’s door: Multinational firms and transfer pricing. Review of Economics and Statistics, 100, 120–134.

Di Giovanni, J. (2005). What drives capital flows? The case of cross-border M &A activity and financial deepening. Journal of International Economics, 65, 127–149.

Egger, P., & Seidel, T. (2013). Corporate taxes and intra-firm trade. European Economic Review, 63, 225–242.

Eicher, T., & Kang, J. W. (2005). Trade, foreign direct investment or acquisition: Optimal entry modes for multinationals. Journal of Development Economics, 77, 207–228.

Flaaen, A. (2017). The role of transfer prices in profit-shifting by us multinational firms. In Proceedings. annual conference on taxation and minutes of the annual meeting of the National Tax Association, JSTOR (pp. 1–40).

Gabrielsen, T. S., & Schjelderup, G. (1999). Transfer pricing and ownership structure. Scandinavian Journal of Economics, 101, 673–688.

Gumpert, A., Hines, J. R., Jr., & Schnitzer, M. (2016). Multinational firms and tax havens. Review of Economics and Statistics, 98, 713–727.

Hebous, S., Ruf, M., Weichenrieder, A. J., et al. (2011). The effects of taxation on the location decision of multinational firms: M&A versus greenfield investments. National Tax Journal, 64, 817–838.

Helpman, E., Melitz, M. J., & Yeaple, S. R. (2004). Export versus FDI with heterogeneous firms. American Economic Review, 94, 300–316.

Herger, N., Kotsogiannis, C., & McCorriston, S. (2016). Multiple taxes and alternative forms of FDI: Evidence from cross-border acquisitions. International Tax and Public Finance, 23, 82–113.

Hijzen, A., Görg, H., & Manchin, M. (2008). Cross-border mergers and acquisitions and the role of trade costs. European Economic Review, 52, 849–866.

Kao, K. F., & Chen, C. S. (2019). Foreign direct investment, input prices, and host country welfare. Review of International Economics, 27, 36–60.

Kato, H., & Okoshi, H. (2019). Production location of multinational firms under transfer pricing: The impact of the arm’s length principle. International Tax and Public Finance, 26, 835–871.

Koska, O. A. (2019). A consumer-surplus standard in foreign acquisitions, foreign direct investment, and welfare. Review of World Economics, 155, 149–179.

Lanz, R., & Miroudot, S. (2011). Intra-firm trade. In OECD trade policy papers, no. 114 (pp. 1–76). OECD Publishing.

Liu, L., Schmidt-Eisenlohr, T., & Guo, D. (2020). International transfer pricing and tax avoidance: Evidence from linked trade-tax statistics in the United Kingdom. Review of Economics and Statistics, 102, 766–778.

Markusen, J., & Stähler, F. (2011). Endogenous market structure and foreign market entry. Review of World Economics, 147, 195–215.

Meier, J. M. & Smith, J. (2020). Tax avoidance through cross-border mergers and acquisitions. In Proceedings of Paris December 2021 finance meeting EUROFIDAI-ESSEC (pp. 1–77).

Melitz, M. (2003). The impact of trade on aggregate industry productivity and intra-industry reallocations. Econometrica, 71, 1695–1725.

Miroudot, S., & Rigo, D. (2022). Multinational production and investment provisions in preferential trade agreements. Journal of Economic Geography, 22, 1275–1308.

Mukherjee, A., & Senalp, U. E. (2021). Firm-productivity and cross border merger. Review of International Economics, 29, 838–859.

Müller, T. (2007). Analyzing modes of foreign entry: Greenfield investment versus acquisition. Review of International Economics, 15, 93–111.

Neary, J. P. (2009). Trade costs and foreign direct investment. International Review of Economics and Finance, 18, 207–218.

Nocke, V., & Yeaple, S. (2007). Cross-border mergers and acquisitions vs. greenfield foreign direct investment: The role of firm heterogeneity. Journal of International Economics, 72, 336–365.

Norbäck, P. J., Persson, L., & Vlachos, J. (2009). Cross-border acquisitions and taxes: Efficiency and tax revenues. Canadian Journal of Economics/Revue canadienne d’économique, 42, 1473–1500.

Prettl, A., & von Hagen, D. (2023). Multinational ownership patterns and anti-tax avoidance legislation. International Tax and Public Finance, 30, 565–634.

Qiu, L. D. (2010). Cross-border mergers and strategic alliances. European Economic Review, 54, 818–831.

Raff, H., Ryan, M., & Stähler, F. (2009). The choice of market entry mode: Greenfield investment, M&A and joint venture. International Review of Economics and Finance, 18, 3–10.

Schindler, D., & Schjelderup, G. (2012). Debt shifting and ownership structure. European Economic Review, 56, 635–647.

Stepanok, I. (2015). Cross-border mergers and greenfield foreign direct investment. Review of International Economics, 23, 111–136.

Stiebale, J. (2013). The impact of cross-border mergers and acquisitions on the acquirers’ R&D-firm-level evidence. International Journal of Industrial Organization, 31, 307–321.

Tekin-Koru, A. (2012). Asymmetric effects of trade costs on entry modes: Firm level evidence. European Economic Review, 56, 277–294.

Wier, L. (2020). Tax-motivated transfer mispricing in South Africa: Direct evidence using transaction data. Journal of Public Economics, 184, 104153.

Acknowledgements

I am grateful to the two anonymous referees for their insightful comments and suggestions. This study was supported by JSPS Overseas Research Fellowships. I also acknowledge the financial support of the JSPS KAKENHI (Grant Number 22H00855). This paper was started when I was a visiting research fellow at Erasmus School of Economics in Rotterdam. I thank members of the institution for their hospitality and support.

Funding

Open Access funding provided by Okayama University.

Author information

Authors and Affiliations

Contributions

HO is the only author and did all for the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendices

Appendix 1: Proof of Proposition 2

With \(\underline{F}^E\), we can easily obtain,

Moreover, we have,

By evaluating at \(\delta =\delta _{\underline{F}_{\tau }^A}\), we obtain,

which means \(\frac{\partial \underline{F}^A}{\partial \tau }>0\) under a range of \(\delta\) which satisfy \(\underline{F}^A\ge 0\).

Finally, given the assumption of \(\xi \equiv 2(1-t)(\alpha +\tau )(\alpha +13\tau )-9(T-t)(\alpha -3\tau )^2>0\), the first derivative of \(\underline{\delta }^E\) with respect to \(\tau\) yields,

Note that

and therefore, \(\theta <0\) holds. Subsequently \(\frac{\partial \underline{\delta }^E}{\partial \tau }<0\) also holds.

Appendix 2: Proposition 3

First, compare welfare between CM&A and GFDI,

Note that the parenthesis in the first line is zero at \(\delta =\underline{\delta }^{min}\); otherwise, it is positive. Therefore, at \(\delta =\underline{\delta }^{min}\), CM&A and GFDI is indifferent from the viewpoint of welfare in the host country. If \(\underline{\delta }^{min}<\delta\), the sign of the welfare difference depends on \(\Delta W^{GA}\), which is either positive or negative because the first term is positive but the sign of the second term is ambiguous. Specifically, the second term is positive when \(t<t^{GE}\equiv \frac{51+10T-\sqrt{51^2+324T+100T^2}}{116}\) holds and negative otherwise. If the tax gap is huge satisfying \(t<t^{GE}\), \(W^G>W^A\) holds. However, if the tax gap is narrow such that \(t^{GE}<t<T\), \(W^G<W^A\) holds when

holds. Therefore, \(W^G<W^A\) holds only when a tax gap between countries is narrow and transfer pricing regulation is loosely enforced; otherwise, welfare under GFDI is larger than that under CM&A.

Subsequently, we turn our attention to the welfare comparison between GFDI and exports. Similarly, we have

From the first expression, \(\lim _{\delta \rightarrow \infty } W^G-W^E\rightarrow \frac{t(\alpha -3\tau )^2}{16}>0\) holds, which means if profit shifting is impossible, and welfare under GFDI is larger than that under exports. Furthermore, at the opposite edge of \(\delta\), we confirm

as the numerator in the first line is minimized at \(\tau =\frac{\{T+(33-16T)t-16t^2\}\alpha }{5(T-t)}\), which provides the first inequality. Hence, at both edges of \(\delta\), \(W^G>W^E\) holds. However, this does not necessarily mean that \(W^G>W^E\) holds. Indeed, \(\Delta W^{GE}<0\) holds if and only if \(\delta _{GE}<\delta <\delta ^{GE}\) holds where

hold.

Finally, we compare welfare under CM&A and exports. We obtain,

Recall \(W^E=W^A\) at \(\delta =\underline{\delta }^{min}\), CM&A leads to a larger welfare than exports when transfer pricing regulation is very loose. On the other edge of \(\delta \rightarrow \infty\), however, \(W^A<W^E\) is possible. From the numerator in the first line of the aforementioned equations, the term is negative if and only if \(t^{AE}\equiv \frac{3(7\alpha ^2+6\alpha \tau -\tau ^2)}{32t(\alpha -2\tau )^2}<t\) holds. Thus, if \(t^{AE}<t\) holds, there exists a unique \(\delta _{AE}\) that satisfies \(W^A>W^E\) under \(\delta <\delta _{AE}\).

Alternatively, if \(t<t_W^{AE}\) holds, \(W^A<W^E\) holds if and only if \(\delta _{AE}<\delta <\delta ^{AE}\) holds, where,

hold.

Note that the following order of the four thresholds \(\delta _{AE}<\delta _{GE}<\delta ^{GE}<\delta ^{AE}\) holds if \(t<\min \{t^{GE}, t^{AE}\}\) holds because the evaluation at \(\delta =\delta _{GE}\) and \(\delta =\delta ^{GE}\) implies \(W^G=W^E>W^A\). Similarly, if \(t^{AE}<t<t^{GE}\) holds, the following order of the three thresholds \(\delta _{AE}<\delta _{GE}<\delta ^{GE}\) hold, since evaluation at \(\delta =\delta _{GE}\) implies \(W^G=W^E>W^A\). This concludes Proposition 3

Appendix 3: Heterogeneous firms over their marginal costs

Let us modify the setting of homogeneous production costs among firms, which is assumed in the main analysis. In line with the empirical finding from the literature on firms’ productivity, we assume firm M has the most superior technology and lowest marginal cost, which we normalize to zero, \(c_M=0\). Moreover, we introduce a different marginal cost between the local firms and suppose firm 1 is a productive local firm and firm 2 is a less productive firm. Specifically, we formulate the marginal costs as \(c_1=\gamma c\le c=c_2\), where \(\gamma\) is a parameter capturing the proportional technological gap between the local firms.

By solving the same game as in the main text, we obtain the set of optimal levels of firms’ outputs and firm M’s optimal transfer price summarized in Table 1. To keep the discussion short, the detail calculation is developed in Online Appendix 2.

With the set of outputs, we can derive the key three thresholds \(\underline{F}^E\), \(\underline{F}^A\), and \(\underline{\delta }^E\). Note that, as shown later, whether firm M merges with a productive firm 1 is ambiguous. Therefore, we obtain two thresholds of \(\underline{F}^A\) and \(\underline{\delta }^E\), and the subscript identifies the target firm of firm M. Subsequently, we have,

where

Hence, we obtain similar thresholds to those in the main analysis. Furthermore, we confirm the same patterns of trade liberalization on the thresholds.

When \(F<\underline{F}^E\) holds, the alternative scheme is GFDI. Notably, whether firm M merges with firm 1 or firm 2 is ambiguous. Let \(\Pi _{Mi}^A\) and \(\Pi _{i}^A\) be firm M’s post-tax profits under CM&A with firm \(i\in \{1,2\}\) and nontarget local firm i’s post-tax profits. Then, firm M’s decision on the target firm depends on the following comparison,

If \(\frac{5a+17\tau }{11}<c(1+\gamma )\) holds, \(\{5a-11c(1+\gamma )+17\tau \}<0\) and \(\left( \Pi _{M1}^A-\Pi _1^{G}\right) >\left( \Pi _{M2}^A-\Pi _2^{G}\right)\) always hold, which implies firm M merges with firm 1. However, if \(c(1+\gamma )<\frac{5a+17\tau }{11}\) holds, the second parenthesis is positive if \((\underline{\delta }^{min})<\delta <\delta _{12}^{G}\equiv \frac{17(T-t)^2}{2(1-t)\{5a-11c(1+\gamma )+17\tau \}}\) holds, whereas \(\delta _{12}^G<\delta\) leads to the parenthesis is negative. Thus, if the transfer pricing regulation is loosely (strictly) enforced, firm M merges with firm 1 (firm 2).

Next, we investigate the comparison between CM&A and exports. Similar to GFDI, whether firm M merges with firm 1 or firm 2 depends on the following,

Again, if \(\frac{5a+17\tau }{11(1+\gamma )}<c\) holds, \(\left( \Pi _{M1}^A-\Pi _1^{E}\right) >\left( \Pi _{M2}^A-\Pi _2^{E}\right)\) holds. In contrast, if \(c<\frac{5a+17\tau }{11(1+\gamma )}\) holds, \(\left( \Pi _{M1}^A-\Pi _1^{E}\right) \gtreqless \left( \Pi _{M2}^A-\Pi _2^{E}\right)\) is equivalent to \(\delta \lesseqgtr \delta _{12}^E\equiv \frac{4(T-t)^2}{2(1-t)\{5a-11c(1+\gamma )+17\tau \}}\). Therefore, under \(c<\frac{5a+17\tau }{11(1+\gamma )}\), firm M chooses firm 2 when transfer pricing regulation is strict, whereas it merges with firm 1 when transfer pricing regulation is loose. Notably, \(\underline{\delta }^{min}\gtreqless \delta _{12}^E\) holds if and only if \(0\gtreqless 3a-5c+11c\gamma -9\tau\) holds.

Finally, by taking a first derivative of \(\delta _{12}^G\) and \(\delta _{12}^E\) with respect to \(\tau\), we have the following,

This clearly means that trade liberalization increases the likelihood that productive firm 1 is the target for firm M’s CM&A offer.

The above discussion is drawn in Fig. 7.Footnote 28 The left figure is illustrated with three different curves. As in the main text, the equilibrium entry modes are based on the solid curves. In the left figure, the two vertical dotted lines capture the thresholds of \(\delta _{12}^E\) and \(\delta _{12}^G\), and firm M prefers merging with less productive firm 2 under the right range of \(\delta _{12}^s\) given the alternative scheme is \(s=\{E,G\}\). Finally, the dashed curves show the thresholds of \(\underline{\delta }_1^E\) and \(\underline{F}_1^A\) and we can ignore these thresholds in equilibrium because firm 2 is firm M’s merger target. Thus, as the dotted lines show, firm M chooses productive firm 1 as a merger target only when transfer pricing regulation is loose. Moreover, the right figure shows the impact of trade liberalization on the thresholds. With each curve, the solid curve is the case of a large trade cost \(\tau =0.5\), whereas the thin curve represents that with low trade cost \(\tau =0.4\). As argued above, the right figure shows the same patterns of the effects on the equilibrium entry modes, and trade liberalization induces firm M to merge with productive firm 1, which is more likely.

Appendix 4: Bertrand competition

This appendix considers the Bertrand model of competition, unlike the Cournot competition in the main analysis. For this modification, we introduce product differentiation. Specifically, we postulate the demand function of firm \(i\in \{M,1,2\}\) as \(q_i=a-p_i+\beta \sum _{j\ne i}p_j\), where \(\beta\) captures the degree of product differentiation. As \(\beta\) decreases, firms’ products are more differentiated. The other settings are the same as in the main analysis.

We can derive each firm’s optimal price as follows. When firm M chooses exports as its entry mode, their prices are,

When firm M chooses to be an MNE, its transfer price is the same as that in the main analysis, \(\widehat{r}=c+\tau -\frac{T-t}{\delta }\), and subsequently, the same tax-adjusted marginal cost \(c_M\) is obtained. With the marginal cost, the optimal prices under GFDI are as follows:

and those under CM&A are,

The aforementioned equations show different feature from Cournot competition. Under price competition, tax-avoidance gains induce firm M to reduce its price \(p_M^s\), where \(s\in \{G,A\}\) is due to lower tax-adjusted marginal cost. In response to the change, local firms also lower their prices and price competition becomes fiercer. Under CM&A, such a fierce competition is mitigated because an increase in firm M’s price benefits the merged entity through an increase in profits from products of its target firm 2. The increase in prices of the merged entity triggers nontarget firm 1 as well. This implies that firm M is likely to choose CM&A over GFDI.

The expressions of firms’ profits are complicated; thus, we rely on numerical analysis to confirm the equilibrium entry modes and the impact of trade liberalization. Figure 8 shows a numerical example of Bertrand competition.Footnote 29 The bold solid curves represent the case with a large trade cost \(\tau =1\), whereas the thin ones show the case under a low trade cost \(\tau =0.5\). In the figure, \(\Pi _M^E>\Pi _M^A-\Pi _2^E\) holds and, thus, when exports are an alternative entry mode of CM&A, exports are profitable over CM&A. Furthermore, \(\underline{F}^E\) is the only curve in the plausible range of parameters, which means that the equilibrium entry mode is either exports or CM&A with GFDI as the alternative entry mode. As mentioned above, GFDI is no longer the equilibrium entry mode. Furthermore, the thin curve of \(\underline{F}^E\) shifts upward in response to trade liberalization. Therefore, we confirm our main results that (i) CM&A (export) is the equilibrium entry mode when transfer pricing regulation is loosely (strictly) enforced and (ii) trade liberalization spurs CM&A but shrinks exports.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Okoshi, H. Attractive target for tax avoidance: trade liberalization and entry mode. Int Tax Public Finance (2024). https://doi.org/10.1007/s10797-024-09830-3

Accepted:

Published:

DOI: https://doi.org/10.1007/s10797-024-09830-3