Research Highlights (Dr. Ryuta Sakemoto)

1. Risk factors for currency portfolios

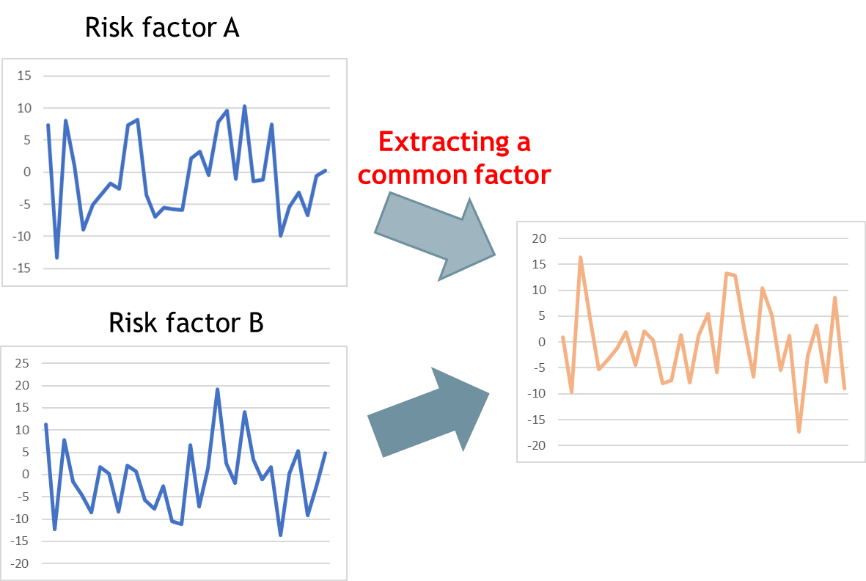

My first research agenda was to discover risk factors for currency portfolios widely used for investors. I extracted the risk factors using the statistical methods given in Byrne, Ibrahim, and Sakemoto (2018, 2019). Figure 1 illustrates the main concept of the methodology. Our studies indicated that our factors were successful in improving pricing errors of the currency portfolios.

Figure 1. Extracting a common factor

2. Commodity prices and macroeconomic fundamentals

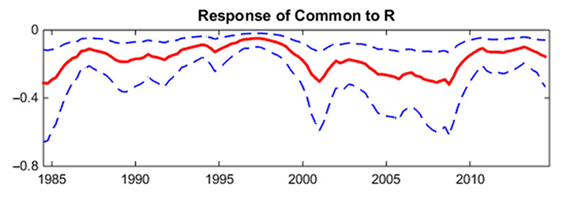

My second research agenda was to reveal a relationship between commodity prices and macroeconomic fundamentals. Figure 2 is one of the findings in Byrne, Sakemoto, and Xu (2020). We noted that U.S. monetary policy had a time-varying impact on commodity price comovements.

Figure 2. Response of the commodity price comovements to monetary policy shocks

3. Portfolio risk management

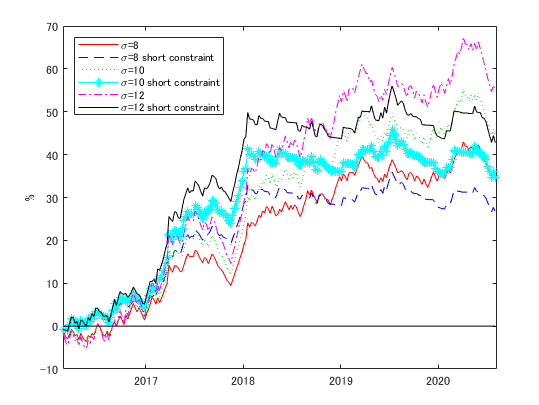

I explored how to control risks in cryptocurrency portfolios. Figure 3 demonstrates that adopting forecast models and optimization techniques allowed us to obtain stable excess returns.

Figure 3. Cumulative returns of cryptocurrency portfolios

Source:Sakemoto (2020)

References

[1] Byrne, J.P., Ibrahim, B., and Sakemoto, R. (2018). Common Information in Carry Trade Risk Factors, Journal of International Financial Markets, Institutions and Money, Vol.52, 37-47

[2] Byrne, J.P., Ibrahim, B., and Sakemoto, R. (2019). Carry Trades and Commodity Risk Factors,Journal of International Money and Finance.Vol.96, 121-129.

[3] Byrne, J.P., Sakemoto, R., and Xu, B. (2020). Commodity Price Co-movement: Heterogeneity and the Time Varying Impact of Fundamentals, European Review of Agricultural Economics. Vol 47, 499-528.

[4] Sakemoto, R. (2020). Economic Evaluation of Cryptocurrency Investment, SSRN3694404.

Link

For further details, please refer to my personal webpage at:

https://sites.google.com/site/rsakemotohomepage/home