Research Highlights: Jiyoung Kim

1. Input–output analysis

Structural propagation analysis

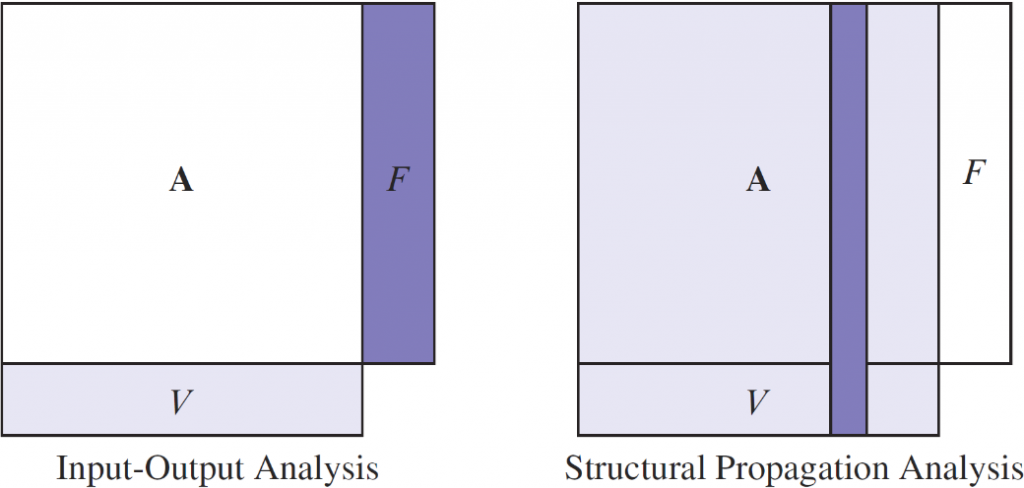

Input–output analysis has been a one-of-a-kind framework that considers industry-wide propagation when assessing the costs and benefits of new goods and innovations. However, it has laid its theory upon the non-substitution theorem, which allows the researcher to study under a fixed technological structure. In Fig 1, left figure displays input–output analysis. If final demands F changes, coefficient matrix A is given fixed, and effects on value added V are measured. On the other hand, right figure demonstrates structural propagation analysis method devised by Kim et al. (2017). If there are any changes in productivity (i.e. technology changes of any industry), it brings out changes in A. In structural propagation analysis, final demands F is given fixed, and effects on value added V are measured. We constructed a multisector general equilibrium model with multifactor CES production functions all with substitution elasticities. Using linked input–output tables for Japan (395 industries) and Korea (350 industries), sector specific total factor productivity growth and elasticity of substitution are obtained. Furthermore, Kim et al. (2021) examined the impacts of ICT innovation using multifactor CES general equilibrium model.

Fig 1. Schematic diagram of input–output analysis and structural propagation analysis

Fig 2. Research presentation at the World Bank seminar in Washington, D.C.

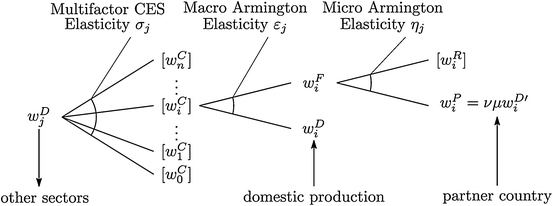

Macro and micro Armington elasticities

Kim et al. (2018) measured elasticity of substitution between foreign and domestic commodities by two-point calibration, such that the Armington aggregator can replicate the two temporally distant observations of market shares and prices. Along with the sectoral multifactor CES elasticities which we estimated by regression using a set of disaggregated linked input–output observations, we integrated domestic production of Japan and Korea, with bilateral trade models and construct a bilateral general equilibrium model. Additionally, assessment of a tariff elimination scheme between the two countries was made.

Fig 3. Nested structure of macro and micro Armington elasticities

2. Flow-of-funds analysis

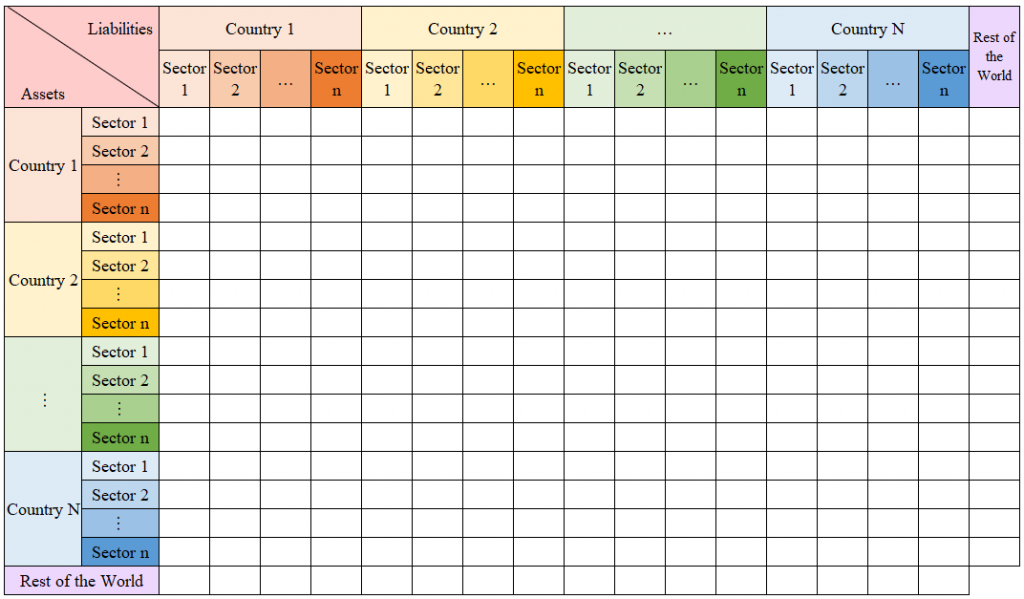

Construction of global financial input–output table

To analyze the global economy, both financial and real sectors should be considered. In fact, financial transactions and trades are two sides of the same coin. Financial transactions between multiple countries represent the global financial market, whereas international trade reflects the real economy. As is well known, international input–output tables, which indicate the real sector, have been developed. However, statistics for international financial transactions are as yet undeveloped. Hagino and Kim (2019) constructed a global financial input–output table that shows both international and domestic transactions by each domestic institutional sector for the U.S. and East Asian countries.

Fig 4. Schematic diagram of global financial input–output table

Case study of developing countries

Burkowski and Kim (2021) analyzed the discrepancy of dispersion index and structural path decomposition from flow-of-funds matrices to discover whether the origins of the recent Brazilian economic defaults were related to the real economy or to pure financial transactions.

References

[1] E. Burkowski and J. Kim (2021) “As Origens dos Recentes Defaults da Economia Brasileira: Efeitos da Economia Real ou Decorrentes de Transações Puramente Financeiras?,” Desenvolvimento em Questão, 19(54), pp.48-67.

[2] J. Kim, S. Nakano and K. Nishimura (2017) “Multifactor CES General Equilibrium: Models and Applications,” Economic Modelling, Vol.63, pp.115-127.

[3] J. Kim, S. Nakano and K. Nishimura (2018) “Bilateral multifactor CES general equilibrium with state-replicating Armington elasticities,” Asia-Pacific Journal of Regional Science, 2(2), pp.431–452.

[4] J. Kim, S. Nakano and K. Nishimura (2021) “The role of ICT productivity in Korea-Japan multifactor CES productions and trades,” Applied Economics, 53(14), pp.1613-1627.

[5] S. Hagino and J. Kim (2019) “Development of U.S.-East Asia Financial Input–Output Table,” The Society for Economic Measurement 16th Annual Conference in Frankfurt, Proceedings.