Research Highlights: [Hiro OKOSHI]

Research interests

International Taxation, Tax Avoidance by multinational enterprises

0. Problems on international taxation: Tax avoidance via transfer pricing

The development of globalization magnifies the impacts of economic activities by multinational enterprises (MNEs). In particular, MNEs’ tax avoidance behaviour across borders has attracted interests over years, and countries deal with the problem based on BEPS projects launched by OECD. Among 15 actions of the project, three target transfer pricing, which means more stricter tax enforcement based on the Arm’s length principle (ALP) is one of the important tasks for both practitioners and researchers.

1. Transfer pricing and location choice

Presentation at ETSG 2019 annual congress

Although MNEs’ tax avoidance is linked to their location, extant literature often ignores location choice. Kato and Okoshi (2019) analysed the impact of the ALP on an MNE’s location choice, and show the possibility that the regulation limits the MNE’s tax avoidance via not transfer pricing but location decision. In addition, Kato and Okoshi (2021) consider agglomeration of MNEs’ plants, and reveals that low trade costs for intrafirm trade allows a high tax country to attract more plants of MNEs, which is a sharp contrast to the result from extant literature showing more firms in a low tax country. Furthermore, Mukunoki and Okoshi (2020) found that a formation of free trade agreement can affect an MNE’s location choice and transfer pricing design, and can restrict its profit shifting. All the above research implies that it is important to take location decision into account once we consider MNEs’ tax saving behaviours.

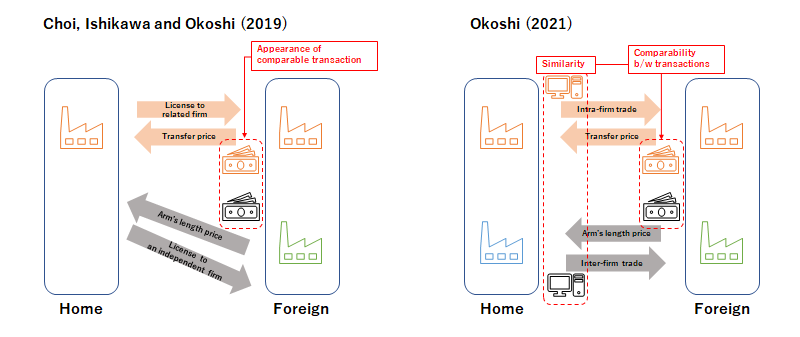

2. Transfer pricing on intangibles

Profit shifting via intangible assets such as patent becomes important. This is because of the nature of intangible assets that it is difficult to find proper transaction price, and for tax authority to apply the ALP. Choi, Ishikawa and Okoshi (2019) consider the trade-offs of licensing of an MNE’s patent to an independent firm: licensing revenue from the firm versus an appearance of a comparable transaction price of the patent. They found different effects on the MNE’s licensing decision and its consequent welfare depending on a market structure. Moreover, Okoshi (2021) focuses on the interrelation between product differentiation and the ease of profit shifting because an application of the ALP is difficult when the intrafirm transacted goods are highly differentiated. Hence, the paper revisits MNE’s R&D incentive and the optimal policy in the presence of R&D activities for product differentiation, and shows some cases where giving MNEs more incentives for R&D deteriorates welfare. Though licensing and R&D investment benefit consumers, these strategies can be influenced with tax avoidance, and it is important to analyse MNEs’ tax planning from more broader points of views.

References

Kato and Okoshi (2019) “Production location of multinationals under transfer pricing: The impact of arm’s length principle”, International Tax and Public Finance, 26(4), 835-871

Kato and Okoshi (2021) “Economic integration and agglomeration on multinational production with transfer price”, MPRA Paper 105536

Mukunoki and Okoshi (2020) “Tariff elimination versus tax avoidance: Free trade agreements and transfer pricing”, Munich Discussion Papers

Choi, Ishikawa and Okoshi (2019) “Tax haven and cross-border licensing”, RIETI Discussion Paper Series 19-E-105

・VoxEU

Okoshi (2021) “Innovation for tax avoidance: Product differentiation and the arm’s length principle” RIETI Discussion Paper Series, forthcoming